That is how eve-trading.net reports it (for tax assumed 3.6%):

There are more than one 'Raptor' available to buy at Amarr and sell at Botane, as they are sold by different prices, they are reported

in separate rows.

There are more than one 'Raptor' available to buy at Amarr and sell at Botane, as they are sold by different prices, they are reported

in separate rows.

This site - eve-trading.net - is an online tool helping users find and filter arbitrage trading opportunities. An arbitrage trading opportunity is a situation, when at one station an item is offered for a 'sell' price, while at the same time at another station there is a 'buy' order for the item, for a price higher than the 'sell' price one can buy the item at the first station.

Pros: High volume of items available to be bought-delivered-sold.For more details of this type of trading please see here.

Someone listed a 'sell' order of 'Raptor' at 'Amarr VIII' for 17,500,000 ISK.

At the same time, at 'Botane - IChooseYou Market and Industry'

there is a 'buy' order, paying for 'Raptor' 21,070,000 ISK. All you need to do, is to buy the Raptor ar Amarr and deliver it

to Botane, selling it for a price higher than you paid for it. You take the risk you may be shot on the way.

Also, you invest your time to perform all the required jumps.

At Botane you earn 21,070,000 - 17,500,000 = 3,570,000 ISK, minus sales tax. The amount of the sales tax depends on your

Accounting skill - between 3.6% and 8.0% see here

or here.

That is how eve-trading.net reports it (for tax assumed 3.6%):

There are more than one 'Raptor' available to buy at Amarr and sell at Botane, as they are sold by different prices, they are reported

in separate rows.

There are more than one 'Raptor' available to buy at Amarr and sell at Botane, as they are sold by different prices, they are reported

in separate rows.

Station trading is when a pilot not leaving a station, performs all the trading there. The profit comes from buying an item for the 'buy' price and selling it for a 'sell' price, as 'buy' price is always lower than the 'sell' price. A pilot-trader places an order at a 'buy' price, waiting for the order to be filled. Once filled, the trader places a 'sell' order of the purchased item, earning the difference between 'buy' and 'sell' price levels, minus tax and the broker fee. The factors involved in the calculation what the actual profit is are: Broker's fee, Relist fee, and Sales tax.

This tool does not support Station Trading.

Pros: No risk of losing the purchased item, as you never leave a station.For more details please see here.

As of March 2022, you can buy at Jita IV a Myrmidon paying 46.6M, and sell it for 54M. You earn 7.4M minus sales tax and broker's fee (both depending on the levels of the skills you trained).

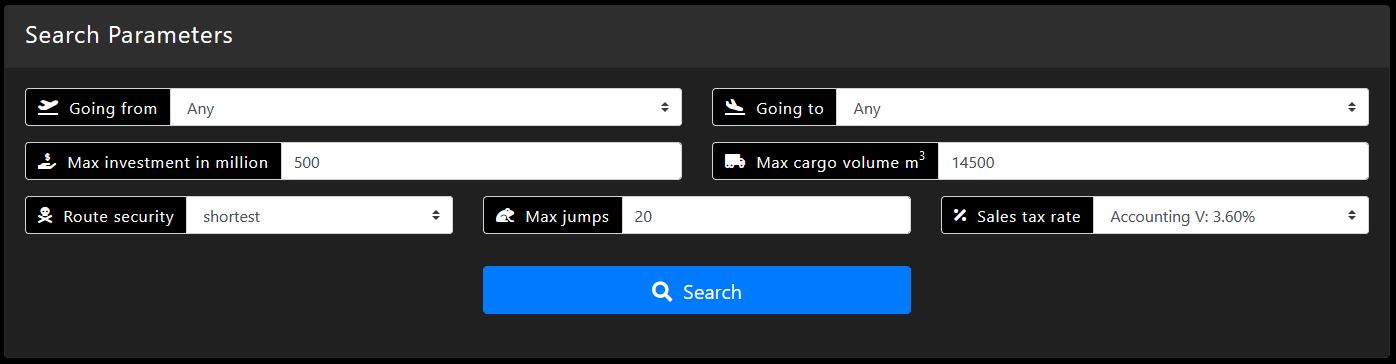

Use Going from and Going to if you like to narrow down your destination start/end. If you specify 'Any', results are not filtered by neither the start nor the end station.

Max investment in million allows you to specify the max amount of ISK you want to spend for the traded items. If it is left empty, the arbitrage opportunities are not filter using the items purchase prices.

Max cargo volume m3 allows you to specify the max volume of the items you want store in your cargo space. It is really helpful to filter out seemingly profitable opportunities, involving items too large for your ship to carry. If left empty, the arbitrage opportunities are not filter using their volume.

Route security may be either secure, insecure, or shortest. It expresses the route safety preference used to estimate the number of the jumps between the station you purchase the item and the station you sell it.

Max jumps Given selected route security, it filters the opportunities by the number of the jumps required to reach from the station you purchase the item to the station you sell it. If left blank, the number of the jumps is not used for the filtering.

Sales tax rate The profit of a given arbitrage opportunity can only be estimated knowing the sales tax you need to pay. This field allows you to specify your Accounting training level, that directly maps to the sales tax rate you need to pay when selling an item.

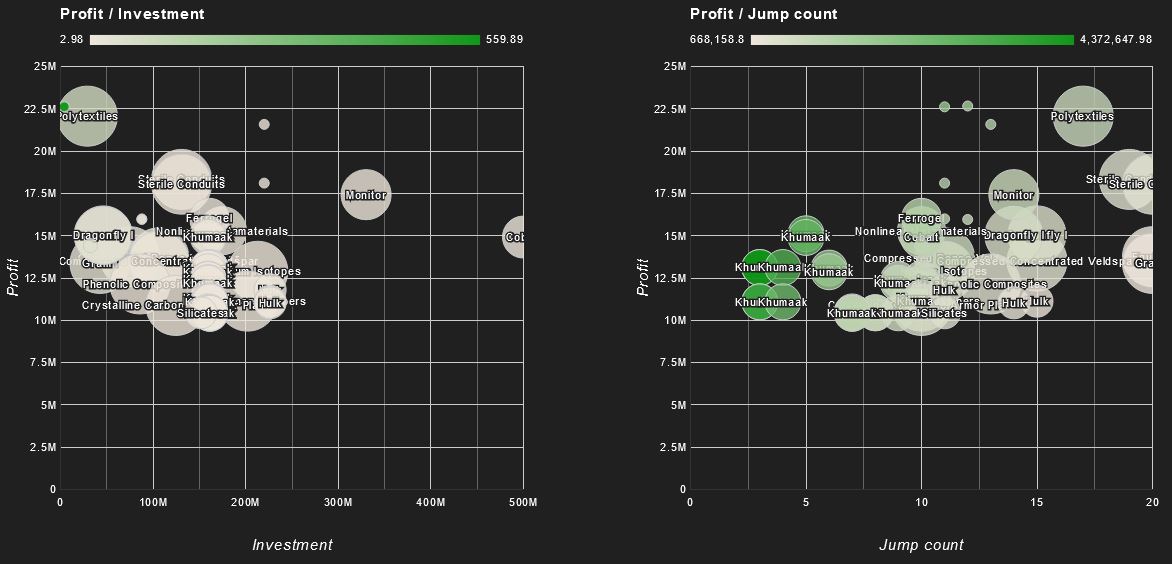

The left chart Profit / Investment summarises the profit, depending on the ISK invested.

The right one Profit / Jump count summarises the profit, depending on number of jumps from the

station you buy the item to the station you sell it.

The left chart Profit / Investment summarises the profit, depending on the ISK invested.

The right one Profit / Jump count summarises the profit, depending on number of jumps from the

station you buy the item to the station you sell it.